The spread of COVID-19 has taken a toll on communities and substantially disrupted many sectors of the economy including the not-for-profit sector. In response, the Federal Reserve established the Main Street Lending Program to assist small and medium-sized businesses and not-for-profit organizations financially impacted by the pandemic.

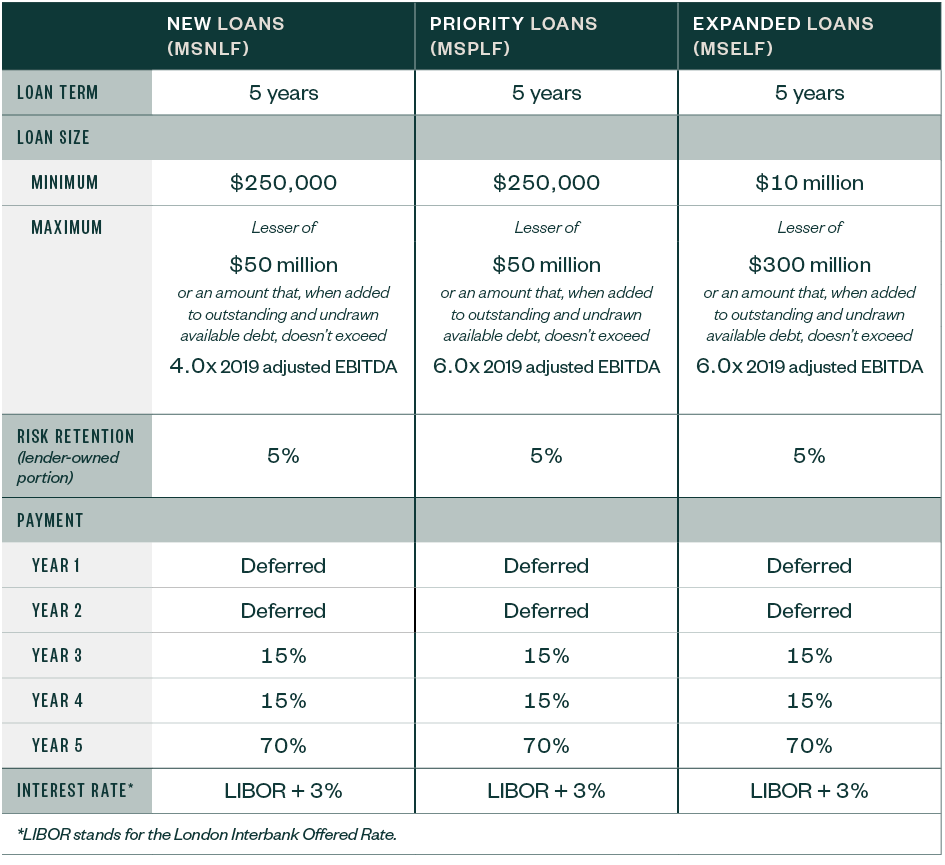

Available program options are outlined below.

Main Street Nonprofit Organization Loans

As noted on the Federal Reserve website, the characteristics of Main Street Nonprofit Organization Loan types are as follows:

The information noted herein may change based on decisions made by the Federal Reserve. For up to date information please visit their website.

Opportunities

The following opportunities are available:

- Main Street New Loan Facility (MSNLF)

- Main Street Priority Loan Facility (MSPLF)

- Main Street Expanded Loan Facility (MSELF)

- Nonprofit Organization New Loan Facility (NONLF)

- Nonprofit Organization Expanded Loan Facility (NOELF)

Eligibility for Available Loans

There are a set of eligibility requirements small and medium-sized businesses and not-for-profit organizations need to meet to apply for the available programs. The Federal Reserve website has a listing of all eligibility requirements and a listing of eligible lenders; an eligible lender should be able to assist with the eligibility requirements.

NONLF and NOELF

In July 2020, NONLF and NOELF were authorized under the Federal Reserve Act. These loans are intended to facilitate lending to nonprofit organizations by eligible lenders. Like the three operating programs noted above, NONLF and NOELF are designed to provide support to not-for-profit organizations and their employees across the United States.

The term sheet for both NONLF and NOELF are available to the public on the Federal Reserve’s website.

Terms

NONLF and NOELF loan facilities will operate similarly to the other operating facilities. The loans will have a five-year maturity with deferral of principal payments for two years and deferral of interest payments for one year.

Eligibility

Currently, both programs have similar eligibility requirements for the borrower. To be eligible to borrow, a nonprofit organization must satisfy certain eligibility criteria set out in the NONLF and NOELF term sheets. The Federal Reserve website has a listing of all eligibility criteria.

Program Loans and Debt

The difference between the two programs relates to loan size and its relationship to existing debt.

Under NONLF, eligible borrowers can apply for a loan ranging from $250,000 to $35 million.

Under NOELF, the loan size ranges from $10 million to $300 million.

Certain criteria determine the size of a loan can be found on the term sheet at the Federal Reserve’s website. There are twelve required criteria that must be met in order to be eligible for funding under both programs.

We’re Here to Help

For more information about the Main Street Lending Program opportunities, contact your Moss Adams professional.